Lila’s Take:

Walter and I decided to come up with a monthly challenge. For January: spend no more than $50 on groceries. That’s $1.62 per day. Who thinks that’s crazy?! We didn’t at first. In fact, I thought that sounded totally reasonable. With the holidays just past, our refrigerator, freezer, and pantry seemed full of leftovers. We always have giant bags of rice, quinoa, and flour on hand. The $50 would be buoyed by the perennial cupboard cans and dried goods that rarely get considered in the process of making meals. In essence we were going to eat our pantry as part of the process of our self-imposed challenge.

We made a comprehensive list of these items and hung it on the fridge with our weekly meal planning list. And then we started! I felt a little breathless in the first few days – it was a slow burn of a wait to see what we would run out of first, what I might need or think I needed. Part of the challenge became just going to the grocery store less – our MO used to be to run to Food Kitty or Trader Joe’s at least twice a week; W and I have unknowingly made independent trips to the grocery store on the same day for the same thing – c’mon, we can be more intentional than that! We clearly saved time and money on gas and impulse purchases by more thoughtfully using what we already had.

By January 14th we’d spent only about $30 during ONE trip to the grocery store and a night out at Pub Quiz, where W had one beer and I wasn’t charged for my DD drink, cranberry juice and seltzer!

Buuut, the problem is we started making exceptions to our rules. These included/sounded like: Seeing a great sale and buying meat to freeze for later consumption (happened on that one grocery trip). “Toilet paper doesn’t count, right? Riiiiight???” What about all non-food, but still grocery store purchases, actually?- trash bags, soap, kitty litter? This grey zone hadn’t been discussed beforehand and was hard to voluntarily define, mid-challenge, mostly because while we knew it would be easier to make such exceptions, we also knew we were only kidding/cheating ourselves. “If I made extra money today then I can spend it on food without it counting, right?” And I know I started getting a little cranky that even one beer was being purchased on our self-imposed, now seeming ridiculous budget. I mean that beer was, like, 6% of our $50! Also, I started glaring at “expensive” things I craved like cheese and grapes. I googled WIC. We didn’t qualify.

Then W found out he needed to go to Florida for a business trip. Me and WV decided to go with him, engendering the next exception question – does his making per diem negate the money we spend on food? Our “exceptionating” was getting out of hand and causing too much needless anxiety. Also, I was starting to feel weird from eating too little protein, which was worrying me since I’m exclusively breast feeding WV. Wet cat food started to smell delicious again (an odd pregnancy craving that I thought I’d gotten rid of post-WV). I wanted to dive into fruit and vegetable displays ravenously chomping like a 400-pound-rabbit in a carrot dream land. I started to take a daily multi-vitamin + fish oil + vitamin D cocktail, which ended a few days later when I looked up a suspicious ingredient – titanium dioxide – which is, you guessed it, toxic. But that’s a subject of an ongoing research project and later post.

Back to our budget. At the laundromat frantically washing and drying clothes for the FL trip we realized we just didn’t have time to make lunch. We decided to split a chicken parmigiana sub from our favorite local restaurant, Tony and Milena’s. That darn sandwich cost $9.80!!! What the what!?! A full third of what we’d spent in 15 days blown on one lunch! I was flabbergasted. They say it only takes a few weeks to form or un-form a habit – well, this not spending money on food challenge had really gotten to me – I felt so wasteful.

Then we went to Florida. The $50 self-imposed limit flew out the window (unless you count per diem as an exception, which we decided not to do; buying food is buying food), although I did make the most out of squirreling away fruit, yogurt and tea from the hotel’s free breakfasts.

So, we failed, utterly failed. I had no idea how much we spent by the end of January (W’s the receipt tracker), but I knew for dang sure it was more than a few hundred dollars – and we iced the proverbial cake of failure by making a Costco run on the 31st. Grr, I’m mad at myself. However, there’s a silver lining to our botched budget breakdown: we learned some important things about what and how we eat. Firstly, in the past we haven’t been nearly as mindful of our grocery purchases. I now abhor spending a restaurant’s price on a meal I could make more healthfully at a fraction of the cost. However/secondly, it’s hard (very hard) to, day after day, come up with healthy, home made meals on the fly when you are sleep-deprived and running on back up brain cells. Inevitably, at the end of the day with a Mt. Everest of dishes to do (from last night), a crying child (no! WV never cries!), a variety of chores glaring at you with beady eyes, three papers to write and publish and a job search, and, oh yea, maybe a shower, it’s hard to start cooking – even though we meal-plan. We often eat diner at around 10pm, actually, because of this. With a little more planning, like instituting a cooking Sunday where we make a crockpot meal for leftovers, freeze some home made pizzas or soup servings for later, and prep others so they are halfway to done for the rest of the week, we could be less wasteful of time, more frugal with money and therefore more successful. Maybe the dishes will get done before WV takes a bath in the sink. We also need to be more mindful about protein – it’s not something we can readily just cut out entirely; however, it’s expensive and there are creative ways to get it. For instance, we made tuna fish nachos two different nights for dinners, which was great, easy and something we’d never tried. I’m grumpy that there are never coupons for produce (although there are coupons for hot pockets galore); produce is essential and probably makes up at least half of our grocery costs. I can’t wait for our garden this year. I will be canning more of our harvest – last year beans and squash went to waste. Also, for some odd reason we ate way fewer eggs overall this month (10) – I think I was subliminally rationing them in case I wanted to bake, later down the line.

So, February? I’m not so naive and disillusioned about grocery costs. Especially after reading W’s take, below. But we can do better! I just know it! Minus Valentine’s Day – we already have reservations at the restaurant where W proposed to me – and of course my birthday, lol! Uh-oh, that’s two exceptions and it’s only February 2nd!

—————————————————————–

Walter’s Take:

I tracked (almost) every penny we spent in 2012. Call me crazy, but I wanted to know how much we spent and on what. I had good intentions to file receipts daily at the beginning of the year, but that progressed into weekly, then monthly, then it turned into “there’s a huge pile of receipts on my desk, I don’t have the time/energy to do this right now.” As the new year started and I was trying to stay on top of current receipts, I was filing receipts from August. I even found a gas receipt from April!

Well, we’re one month into 2013 and I think I’ve got everything filed from 2012. Since we tried the whole $50 for food for the month of January, I decided to run a little report on our food expenditures. My jaw hit the floor when the following chart was displayed on my screen:

We averaged $764.98 per month on food for both of us – including groceries and dining out. And yes, this also included buying beer and wine both in the grocery stores and in restaurants/bars (not including taxes or tips). That’s $278.19* per month going out to eat and $486.78* per month in groceries. Holy cow! But check the bars from June through September – those were the months our garden was in full bloom!

I started to do some research, and found some numbers that made me feel a little bit better. The 2011 per capita food expenditure for the United States was $352.42 per month (2012 data hasn’t been released). But that’s per capita. So multiply that number by 2 and you get $704.84. And that doesn’t include alcohol. Our average monthly food expense for the two of us not including alcohol comes out to $605.62. Whew, we’re below the national average! But that’s still a lot of money to spend on food – over $20 per day? We thought we could get away with spending less than 1/10 of that!

For January 2013, I can report that we have spent $560.32 on grocery store and restaurant food and drinks. This number includes the money we spent on seeds for our garden, the “let’s buy this and freeze it since it’s a good price” exception, and a Costco run we did on the 31st when we were staying with my parents – we’ll be EATING this food in February, but since we PURCHASED it in January, I felt obligated to include it in the report. An improvement over our monthly average last year, but we still think we can get it lower… If you remove the exceptions, it’s down closer to $350.

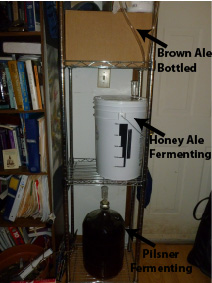

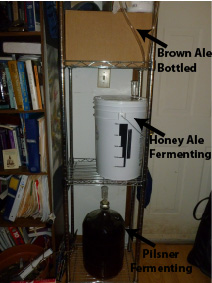

And we won’t be spending as much money on buying beer this year. Yesterday I opened my first bottle of a nut brown ale that I bottled on 1/1/13, I have a Pilsner ready to be bottled, honey ale ready to be transferred to the secondary, and since the brown ale turned out so delicious I think I’m gonna brew another batch soon to get the fermentation on it started. Why buy it when I can make it for about half the price?

Here’s to being more thoughtful about food purchases in 2013 and less wasteful with money, fuel, and food!

*I know, these numbers add to $764.97. I rounded.

Originally made for a certain baby, but as you can see here, after choosing the best organic apples, washing them, peeling them, juicing them, reconstituting them, heating them, and finally pureeing them…WV DID NOT WANT TO EAT THEM. He made several adorable “this sucks, mom” faces, pulled off his cute bib, and spit them out. Okay, so now it’s adult apple sauce.

Originally made for a certain baby, but as you can see here, after choosing the best organic apples, washing them, peeling them, juicing them, reconstituting them, heating them, and finally pureeing them…WV DID NOT WANT TO EAT THEM. He made several adorable “this sucks, mom” faces, pulled off his cute bib, and spit them out. Okay, so now it’s adult apple sauce.